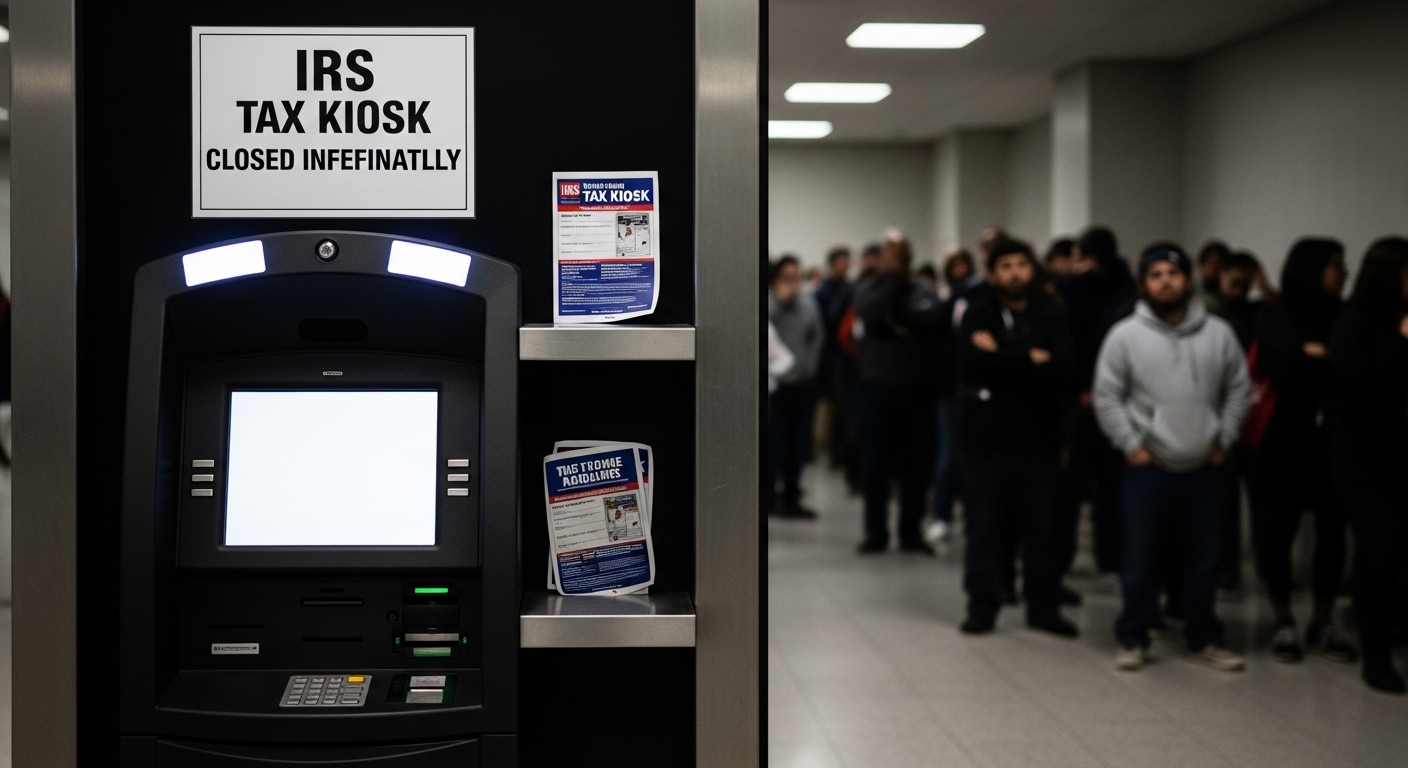

The topic of irs tax kiosk closures has gained attention as more taxpayers notice changes in how in-person tax assistance is delivered. IRS tax kiosks were designed to provide convenient, self-service access to basic tax forms, information, and limited assistance in public locations. Their gradual closure reflects broader shifts in government service delivery, technology adoption, and budget priorities. For many individuals, especially those who relied on face-to-face options, these closures raise concerns about accessibility and support. Understanding why these kiosks are closing and how it affects taxpayers is important for navigating the evolving tax assistance landscape with confidence and clarity.

What Were IRS Tax Kiosks Designed to Do

IRS tax kiosks were introduced as a way to extend basic services beyond traditional IRS offices. These kiosks were typically placed in public buildings and offered access to tax forms, informational materials, and digital tools for common tax-related tasks. The goal was to reduce congestion at IRS offices while making tax resources more accessible to the public. For taxpayers without reliable internet access or those who preferred in-person guidance, kiosks served as a helpful middle ground. Over time, however, usage patterns shifted as more people moved toward online filing and digital communication. This change in behavior played a role in reassessing the long-term value of maintaining physical kiosk locations.

Reasons Behind IRS Tax Kiosk Closures

Several factors have contributed to irs tax kiosk closures in recent years. One major reason is the increased reliance on online tax services, which allow taxpayers to access information and file returns from home. Maintaining physical kiosks requires staffing, maintenance, and security, all of which involve ongoing costs. As budgets are evaluated, agencies often prioritize services with the highest usage and efficiency. Technological advancements have also made many kiosk functions available through official websites and digital platforms. Additionally, changing security standards for handling sensitive tax information have influenced decisions to limit public-access terminals. Together, these factors have led to a gradual reduction in kiosk availability.

Impact on Taxpayers and Local Communities

The impact of irs tax kiosk closures varies depending on location and individual needs. For tech-savvy taxpayers with internet access, the change may be minimal. However, for seniors, low-income individuals, and those in rural areas, kiosks often provided a vital access point for tax assistance. Local communities that relied on these services may now face longer travel times to reach IRS offices or increased dependence on third-party help. The closures can also place additional pressure on community organizations and volunteer tax assistance programs. While digital options continue to expand, the transition highlights the ongoing challenge of ensuring equal access to essential government services for all populations.

Alternatives Available After Kiosk Closures

Following irs tax kiosk closures, taxpayers are encouraged to use alternative service channels. Online IRS tools now offer a wide range of functions, including form downloads, payment options, and account management. Telephone support and mail-based communication remain available for those who prefer traditional methods. In some areas, IRS offices and authorized assistance centers continue to provide in-person support by appointment. Community-based programs also help fill gaps by offering free or low-cost tax preparation services. While these alternatives can be effective, they require awareness and planning. Understanding available options helps taxpayers adapt to changes without missing important deadlines or assistance opportunities.

Broader Implications for Government Service Delivery

The trend of irs tax kiosk closures reflects a broader shift in how government services are delivered. Agencies worldwide are moving toward digital-first models to improve efficiency and reduce costs. While this approach offers convenience and scalability, it also raises questions about inclusivity and digital access. Balancing modernization with public needs remains a key challenge. The experience of tax kiosk closures serves as a case study in how service transitions affect real people. It emphasizes the importance of clear communication, transitional support, and continued investment in accessibility as governments evolve their service models.

Conclusion

Irs tax kiosk closures mark a significant change in how tax assistance is provided to the public. Driven by technological advancement, budget considerations, and changing user behavior, these closures reshape the taxpayer experience. While digital alternatives offer convenience for many, the shift also highlights the need to address accessibility gaps. By understanding the reasons behind the closures and exploring available options, taxpayers can better navigate the evolving tax system and continue to meet their obligations with confidence.